Wednesday 8th November 2023 saw the Department for Business and Trade publish its eagerly awaited response to an earlier consultation on changes to annual leave and holiday pay calculations as well as TUPE consultation requirements.

Ultimately, the consultation paper confirms that, at present, only minor changes are to be made to EU-derived Regulations.

The takeaway headlines are:

Rolled-up holiday pay will be making a comeback.

The 12.07% accrual method of calculating holiday entitlement for irregular and part-time workers will return.

Consultation in TUPE transfers will become less onerous.

Rolled-up holiday pay is where a worker receives an enhancement with every pay slip to cover their holiday pay, as opposed to receiving holiday pay only when they take annual leave. It is currently unlawful and has been since 2006, following a ruling by the European Court of Justice which expressed concern that workers would not utilise their holiday entitlement having already received pay for it.

The re-introduction of rolled-up holiday pay was originally going to be an option for all workers. However, the consultation confirms that it is going to be limited to those working irregular hours and to part-year workers. This is to avoid the risk of disincentivising permanent or fixed-hours employees from taking leave.

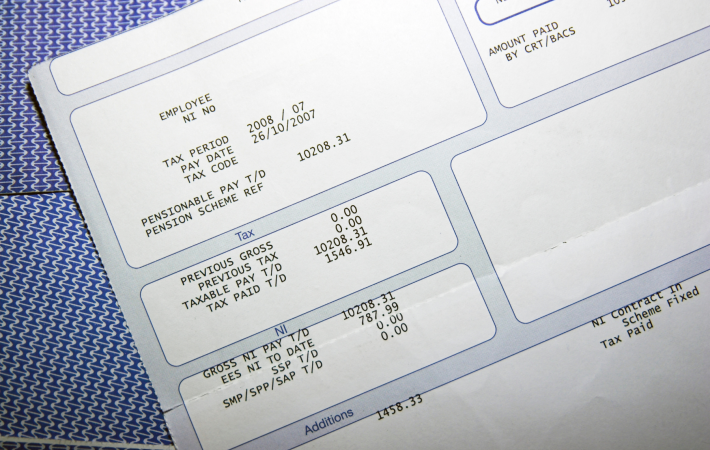

The consultation response suggests that 33% of responses disagreed with this proposal suggesting that it is a controversial reform, most likely due to concerns as to whether holidays will be utilised. In practice, it is likely to be a welcome introduction for atypical workers but may cause a financial and administrative burden to employers, as any rolled-up holiday pay will need to be clearly marked on wage slips.

Anyone who works in HR or employment law will remember the case of the Harpur Trust v Brazel which resulted in part-year workers being entitled to a greater annual leave entitlement than part-time workers who work the same number of hours across the year. An outcome which has been called ‘absurd’.

12.07% is used because 5.6 weeks’ holiday is equivalent to 12.07% of hours worked per year, this figure being reached by dividing 5.6 by 46.4.

Prior to this decision, the 12.07% method was used by the vast majority of employers to calculate atypical workers’ annual leave. In fact, the Government website and Acas actually recommended using this method until the outcome of the Harpur case.

The consultation response confirms that a whopping 83% of responses agreed that this method would be the fairest way to calculate holiday entitlement for workers with irregular hours.

Currently, in the midst of a TUPE transfer, it is necessary to nominate and elect employee representatives and thereafter consult with these representatives about the transfer. The consultation confirms that, for some employers, it will do away with this requirement completely and allow businesses to consult their workers directly. As above, this only applies to:

Businesses with fewer than 50 employees

Businesses of any size involved in a transfer of fewer than 10 employees

In practice, many employers already choose to consult directly with their employees, but this reform should provide greater flexibility and simplify the process.

The response confirms that legislation will be put in place to clarify that employers do not have to record the daily working hours of their workers in order to comply with the Working Time Regulations.

The clarifications surrounding the calculation of holiday pay will be welcome news for employers who have had to deal with ever-changing case law over the past couple of years. Otherwise, all other key areas of retained EU employment law will be preserved, as such there is to be no ‘bonfire’ of employment rights at the end of 2023 as initially expected.

A draft statutory instrument setting out the changes outlined above is already before parliament with a coming into force date of 1st January 2024 so these changes could be in place shortly. Watch this space!

If you are concerned about the impact of any of these changes, please get in touch with our employment law team.

Contact Nicola to discuss this further.